Finances & Lifestyles

Financial Status of the Elderly: To understand the Social

Security Story, it might be good to go back to chapter one lecture and

review Modernization Theory.

The Social Security Story

| In the 1920’s, only one in ten households was electrified | |

| Only one out of 100 houses possessed a radio | |

| Only one in three families had a car | |

| And the elderly

still lived mainly with their families, although three to five percent were in the Almshouses. Almshouses were the early forms of institutionalization. You can find a plethora of definitions for Almshouses, if you are interested, at the following link. http://www.encyclo.co.uk/define/Almshouse |

History : Here are two sites to help you understand the history of Social Security. I like the second site more. If you don't have audio abilities, I have listed a link for alternative text file.

This site covers the history http://www.ssa.gov/history/history.html However, this site is much more fun (you will need real audio player to hear this file):

http://www.ssa.gov/history/sounds/ss1.ram

Click Here to hear the history of Social Security.

(It will occasionally stop to reload)

Alternate text file. - Just for fun, you might want to read also because it is much more in depth.

http://www.ssa.gov/history/briefhistory3.html

Extra Credit 3 points: Email me (don't post it or it will ruin it for everyone else) with the name of the first persons who received U.S. Social Security benefits ( the first regular benefits and the first payment). How much were they? You need two names here so read the question carefully. Be sure to put Psych 374 or gero302 extra credit in the subject line.

_______________________________________________________________________________________________________________________________________

We pick up the Social Security story at the stock market crash of 1929. The crash created a great economic depression. The results were massive unemployment, depressed stock prices, lost fortunes, bankrupt companies and deflated prices.

Local governments encountered staggering welfare burdens, because up to 60% of Americans were unemployed.

Many people were homeless, medical care was sparse and malnourishment and starvation were widely reported.

Receiving support from the working and middle class, President Roosevelt (1932), created a variety of programs that propelled the Federal Government, for the first time, into the social welfare arena. These programs provided economic relief, jobs, security, and food to Americans.

In 1935, he passed the Social Security Act, which was originally conceived as a measure to provide pensions to retired workers. Social Security was later expanded to provide benefits to family members of disabled or dead workers .

This is a great video clip of Roosevelt signing Social Security into law. http://www.ssa.gov/history/mpeg/fdrbig.mpg (it requires a Media Player and takes a few minutes to load, so be patient. It's worth the wait. (19.7 meg)

Alternate file is also located at http://www.ssa.gov/history/history6.html

If you don't have a media player go to this site http://www.ssa.gov/history/mpeg/videosound.html

Click on "FDR's speech at the ceremony of the signing of the Social Security Act in 1935", video clip . It will prompt you to download Real Media.

- Indexing of Social Security

The financial status of the elderly improved with the advent of Social Security (1935) and later post World War II pension programs. Most historians agree it was the war, not Social Security, that got the U. S. out of the depression. Still, many credit Roosevelt's new programs.

America was experiencing a huge pent-up demand for products after WWII. The country had been at war, and families had not been growing. Production of new homes, cars, electric appliances and other goods that drive the American economy had been at a stand still.

When the war ended, and the men came home, a baby boom occurred along with demand for the products that growing families need.

A strong economy created higher prices and, thus, the devaluation of Social Security benefits (remember, when inflation goes up, the value of money goes down because it costs more for the same goods).

There was a stark contrast between the affluent society of the working class (who had unions, pensions, and benefits and could buy the first suburban homes, TV's, and washing machines) and the income problems of older people. Again, there was rising poverty among the elderly.Almost a quarter of the elderly were still in poverty, and that number was increasing rapidly as the economic growth and earnings of the 1950’s continued. Inflation continued to devalue the amount that Social Security benefits paid to retirees.

How is Inflation Determined?

Inflation is determined by the cost of a market basket of goods (e.g. bread, milk, eggs, etc). When these costs go up for a consumer, inflation (cost of living) is said to have occurred. The government actually purchases selected items to determine changes in the economy.Because the economy was strong, Congress began periodically revising Social Security benefits upward to compensate for inflation. NOTE: when the economy is strong the government collects more taxes and thus has more money to spend.

Beginning in the 1970’s, indexing or increasing Social Security payments to match the cost of living increases (the cost of a market basket of goods) was instituted without any increase in payroll taxes. These increases were called "Cost of Living Adjustments "or COLA’S.

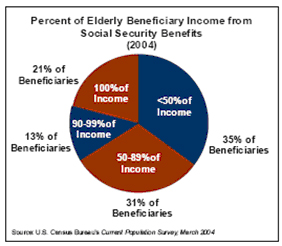

As a result, between 1950 & 1991, the poverty rate among the elderly dropped from over 52% to just 11%.Although never intended to be the sole source of retirement income, for more than 50% of the elderly, Social Security is their sole source of income.

A. There are four Social Security Trust Funds

- Old Age and Survivors Insurance (OASI) - this is the program that provides check to retirees

- Disability Insurance

- Hospital Insurance Trust Fund ( Medicare Part A)

- Supplementary Medical Insurance (or Medicare Part B)

We will discuss the Old Age and Survivors Benefits (OASI) portion here and discuss Medicare benefits later.

- OASI

When you work, you pay taxes (FICA) into Social Security (based on your earnings), and when you retire or become disabled you and your family members collect monthly benefits (based on your contributions). Thus the higher your wages, the higher your benefits.

Your portion of the payroll tax is 7.65% of your gross earnings (if you are not self-employed). Your employer matches that amount for a total of 15.3% of your gross earnings being paid into the Social Security Trust Fund. Of your 7.65%:

5.30% is used for retirement and survivors benefits1.45% for Medicare (the medical insurance program of Social Security)

The Medicare program is in real trouble. Read this http://www.cdc.gov/nccdphp/aag/aag_aging.htm.90% for Disability Insurance

Total 7.65%

This amount is matched by your employer (unless you are self-employed, then you pay both portions or, 15.3%) up to a maximum earnings in 2010 of $106,800. After you earn that amount you do not have to pay any more Social Security Tax for that year.

Check out your handout

Social Security – How You Earn Credits

Social Security benefits have been declining recently. This has delayed the retirement of many people http://researchnews.osu.edu/archive/socialsecurity.htm. The average monthly payment (2010)is around $1,164.mo. "Based on their own earnings records, women can, on average, expect lower Social Security benefits than men with the same number of years of covered earnings" https://www.actuary.org/pdf/socialsecurity/women_07.pdf

For the average wage earner, this replaces about 43% of his/her pre-retirement income. For the wealthy, it replaces about 23% of their income.

Social Security’s principle is that through payroll contributions, workers earn a right to protect themselves and their families against the risk of reduced income and economic uncertainty (either from retirement or the death of the breadwinner).

Social Security’s benefits are earned and are not related to an individual’s other income or assets. Anyone who pays into the system is eligible: The President of the United States, professional athletes, laborers and service personnel. There is no means testing to qualify.

"Means" Tested Program Versus "Entitlement"

Means testing programs, like TANF (Temporary Aid for Needy Families) or Supplemental Security Income (SSI), are granted based on income needs. One must be low income to qualify.

Entitlement programs are not "means" tested and one is entitled to them when they earn the terms of the program. An example is Social Security and Medicare .Beneficiaries must have worked at least 10 years or 40 quarters in employment covered by Social Security to quality.

Benefit amount is also affected by age at the time one starts receiving benefits.

| The earliest age

that you can draw benefits is age 62. Normal retirement age is now 65-67(depending on your birth year) . If you elect to draw benefits at 62 your benefit will be permanently lower than if you waited until age 65-67. The reduction is about 20% if your full retirement age is 65. |

Full retirement age increased from 65 to 67 to help save costs and because of longer life expectancies.

| This change started

in the year 2003 and it affected people born in 1938 and

later. So if your full retirement age is 67 the reduction for early retirement will be more. |

| If on the other hand

you delay your retirement you can increase your benefits by 5.5% per year until age 70. |

| Widow(ers) can begin receiving benefits at age 60 or age 50 if disabled. |

If you receive widow or widowers' benefits (even if you are divorced) you can switch to your own benefits as early as age 62 (assuming they are higher).

Spousal benefits are 50% of the retired workers benefits.

| A divorced spouse

can get benefits on a former husband's or wife’s Social

Security if the marriage lasted at least 10 years, and

he/she has not remarried. | |

| You must be age 62 or older. The amount of benefits a divorced person receives does not affect the amount of benefits the ex spouse receives. |

II. Trust Fund Outlook

Since 1983, the Social Security Trust Fund has operated on a "partially pre-funded" basis, meaning future benefits are anticipated and partially funded in advance.

Historically, the trust fund was funded on a "pay as you go" basis. Taxes and benefits were adjusted so that there was no reserve accumulated. Under this system, the elderly were not supported by the payments they made into the fund, but by the current taxes paid by younger workers. This is essentially how Social Security was structured from the 1950-1970’s.

When the large number of baby boomers become eligible to receive benefits, there will be only two workers for every senior citizen collecting benefits, compared to a 15 to 1 ratio when the program first began (Do you remember what the dependency ratio is? If not, go back and look at Lesson Two).

The U.S. Government has foreseen the impending crisis and has taken some measures to compensate.

A Social Security savings account was created in 1983.

The creation of "pre-funding" allows the fund to have a surplus. Taxes collected are more than benefits paid out. Theoretically, the surplus is kept in reserve to fund the program when the workforce to benefit recipient ratio decreases.

This method of funding the Social Security system shifts some of the retirement burden from future workers to the large currently-working group itself.

Other steps (besides increasing the age of full retirement and pre-funding the program) that were taken to keep the fund solvent include the creation of a penalty for earnings over $9,000 when receiving benefits. Recipients were taxed

$1.00 for each $2. earned if under age 65

$1.00 for each $3. earned if 65-69

After age 70, there was no penalty

This penalty tax was repealed by President Clinton in hopes of keeping workers in the workforce longer and to assist them in earning extra cash after retirement. It was anticipated that this would save the Government money, because retirees would be more self-sufficient and not dependent on other Government programs, and they would continue to pay employment taxes, adding to the social security fund.

Originally it was believed that pre-funding the system would keep Social Security solvent for the next 75 years, but the predictions were not accurate.

Government borrowing resulting from large budget deficits outside of Social Security undermines this goal. Social Security funds have been used to meet the Federal deficit . Also, the current economic situation (high unemployment rate) has forced many people to retire earlier than expected.

An article that appeared in the San Francisco Examiner 6/97 entitled "Don’t Blame the Elderly" explains the Regan Years and his "Star Wars" spending. Regan ran huge Federal deficits as spending on Star Wars expanded. Congress was upset at the growing national debt, and Regan needed to convince Congress that he was not overspending. Each year's deficits were creating a huge Federal Debt.

The Social Security Trust Fund (that's the lock box Vice President Gore talked about) historically was a trust fund and separate from the US treasury. Regan combined this trust fund with general revenue fund to make it look like the U.S. Treasury was actually taking in more money than it was.

To put this into perspective, assume you take your child's piggy bank and add it to your weekly income. The family has more money to spend, but each month as you borrow and spend your child's allowance, you are running up a debt with your child. By spending more than you have each month, you create a shortage. These monthly shortages create a family debt.

The Government has borrowed so much of the Trust Fund that each of us would have to be taxed in order to repay it. Some of the money President Bush returned to Americans in his tax plan in 2001 was money many say was owed to the Social Security Trust Fund.

Using an analogy again, let's assume you owe your child $2,500 from borrowing out of his piggy bank each month. One month you find that you did not spend as much money as you usually do and you earned a bit more income than usual. Should you repay your child's piggy bank? Or spend the extra cash? Some say Bush spent the piggy bank money.Here is a good site to help with balance the media's portrayal of the system ;http://www.socsec.org/publications.asp?pubid=507

When the economy grows, workers earn more money, pay more taxes, making more funds available to fund current retirees. But, economists claim that the Social Security program will go bankrupt by the year 2029.

"According to CNN http://money.cnn.com/2005/02/02/retirement/reality_check_stofu/ SS will not actually go bust as we are being told. By 2042, using projections from the Social Security trustees, or by 2052 if we follow the Congressional Budget Office, the system will be unable to pay in Full their current projections. The numbers actually reveal the system will be able to pay 75%-80% of their future projection.

According to one State representative, the whole program is still the most successful the government has ever established. With only minor adjustments in the next 37 years, the system will remain intact. http://bernie.house.gov/documents/opeds/20050302124453.asp

If the current projections do hold and nothing is changed, the loss to someone 63 in 2042 would be about 27% cut from today's current numbers (that I see is not taking into account inflation). If that person lived to 100, he/she would have a 33% cut to his/her benefits. This is according to the 2004 Trustee report. http://www.ssa.gov/qa.htm Gary Walmer, student

Since 1960, the number of people 65 and over has increased by 100% in comparison with a 45% growth rate for the population in general.

Many say, however, that 'Demography Is Not Destiny'. The looming prediction that a crisis is going to occur does not consider many other factors. This site asks the question, "Should we base policy on our fears?" Check it out. http://www.asaging.org/at/at-202/report.html

Extra Credit- up to 3 points possible -- What do you think? Will Social Security still be there when you retire? After reading this week's text, lecture, and related links, tell us your views and rationale at the discussion link.

To receive credit, you must give numbers and not just WAGS and tell us where you got your information. Explain your views of the trust fund now that you have read about it.

You must note "extra credit" in the subject line. No credit, as usual for repeating what has already been posted.

Social Security helped reduce poverty by indexing Social Security to the rate of inflation which improved the elderly’s financial status even more. Today, nearly 50% over the age of 65 would still be in poverty if not for Social Security.

Poverty Rates

What income level is considered poverty? This Government site will give you more

information

Dept.

Health and Human Services Poverty Guidelines 2009/2010

As you can see, a single adult at the poverty level earns just a little over

$900.00 per month. Could you live on that amount?

III. Reporting Income Levels of the Elderly

The "Median" income is used to explain yearly income of the elderly. Because wealth is not evenly distributed, an unusually high or low-income figure can make average reports misleading. For example, if I were to average out the ages of students in this class, I might find the following:

Formula for averaging

the age of students in this course:

Sum the total of all ages /divided by number of students

in the class = average age

Suppose the ages of class mates were as follows.

19,25,33,39,40,22,25,26,34,36,& 80

Total 379/11= 34.5 years

If, however, we left off the 80 year old, (an unusually high number) the average would look very different.

The total would only be 299/10 or age 29

Median reports are in the middle; that is, there are as many incomes above the median as there are below. To find the median age in our class room we would need to group like ages together-- like this

19,22,25,25,26,33,34,36,39,40,80

Since there are 11 numbers, number six would be the median or age 33

As you can see, if we used averaging, one elderly with an extremely high or low income would distort the results.

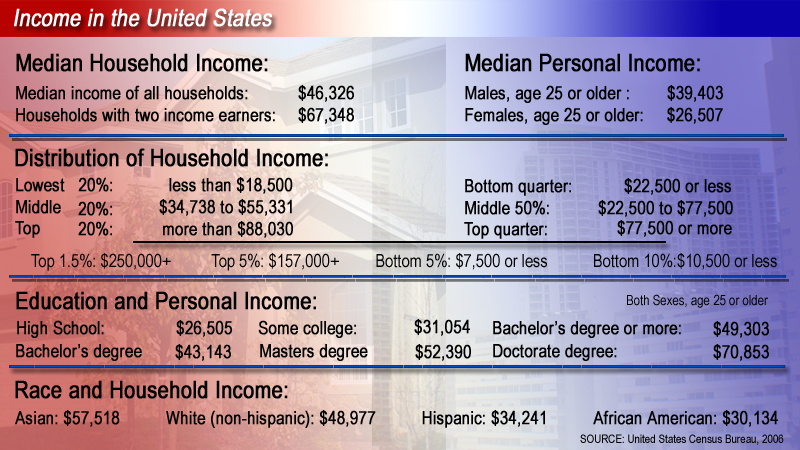

A. In 2008 Median Incomes of the elderly were:

| $25,503 for men | |

| $14,559 for women ($1006.mo) |

| 20.3% of all seniors had income of less than $10,000 | |

|

36.3% had incomes over $25,000 http://www.aoa.gov/aoaroot/aging_statistics/Profile/2009/9.aspx |

Households containing families headed by persons 65+ reported a median income in 2008 of $44,188

$48,859 for Asians

$46,527 for non-Hispanic Whites,

$35,025 for African-Americans

$32,901 for Hispanics

http://www.ncpssm.org/socialsecurity/seniorincomestats/

Source: U .S. Census Bureau, Housing and Household

Economic Statistics Division (Last Revised: January 13, 2006), Estimates of

Resident Population (March 2004), Current Population Survey, (March 2004 );

Social Security Administration, Master Beneficiary Record

Here is a

comparison to the general population

Want a motivation to stay in

school? Check out the income levels for educated persons.

B. Incomes for poverty are

calculated differently for the elderly. Read this take from Center on Budget and

Policy Priorities

http://www.cbpp.org/7-19-05acc.htm

Federal Poverty Guidelines for 2009

http://aspe.hhs.gov/poverty/09poverty.shtml

[before the economic crisis] "13.7 million seniors remained barely above this income range, with disposable incomes between one and two times the poverty line (between $8,825 and $17,650 a year in 2003 for a senior living alone). While seniors are the least likely age group to live below the poverty line, they are the most likely age group to be just above the poverty line. (It should be noted that many near-poor seniors are not counted as poor because of a quirk in the poverty line itself.

The federal poverty line is set 8 to 10 percent lower for elderly single individuals and couples than for similar non-elderly individuals and couples. Most of the elderly live alone or with a spouse. If the poverty definition were adjusted to use the same poverty line for the elderly as for the non-elderly, the poverty rate for seniors would be slightly higher, rather than lower, than the poverty rate for younger adults."

Center on Budget and Policy Priorities. http://www.cbpp.org/7-19-05acc.htm

About 3.6 Million elderly persons (10.4%) were below the poverty level in 2002. But the past recession has brought the poverty level in the USA to above 13% for all ages. We do not yet know how many seniors are included in that number. The 2010 census will help us understand the effect of the economic downturn on the elderly.

We do know that the number of elderly poor is increasing as their retirement investments, pensions and social security payments decrease their monthly income. Many seniors relied on the value of their homes for retirement income or to finance their long-term-care needs. Because of falling housing prices and the inability to get loans for new buyers that resource is no longer available. This means many elderly are "stuck" in homes they can neither live in alone or sell.

Listen to an interview with Michael Hurd, director of the Center for the Study of Aging at the RAND Corporation. (MP3: 15 minutes) http://www.prb.org/journalists/webcasts/2010/recessionolderamericans.aspx

| From the last census we know that

17.3 million seniors are nearly poor (125% of poverty). These folks are

said to fall through the cracks. Too poor to pay for their care and too rich to qualify for many services and programs. These numbers would double if the Federal Poverty index were updated as many experts recommend. Some argue we need to catch the single people who fall between the cracks at 130% and 150% of the poverty level . | |

| Health care costs further complicates life for low income people because as we age, there is an increased need for health care. Marginally poor can spend up to 1/3 of their income in direct out-of-pocket expenses for health care. |

III. Diversity, Income and the Elderly- According to your Author, a disproportionate number of ethnic groups have higher than average poverty rates. "Older women, ethic minorities and those who live alone consisted nearly 90% of the elderly poor " Hilliar, 2010

E.g., in 2008 (new data not yet available)

| 8.6 non Hispanic whites | |

| 24.7 African Americans | |

| 24.5 Latinos http://www.heritage.org/Research/Reports/2006/10/Importing-Poverty-Immigration-and-Poverty-in-the-United-States-A-Book-of-Charts | |

|

Older women's poverty rate was 12.4% while older men's was 7.7% | |

| Persons living alone are much more likely to be poor, 19.2%, compared to persons living with families 6.0% | |

| The highest poverty rates were older Latino women living alone |

http://www.npc.umich.edu/poverty

Do You Remember what it is called to be an older, minority woman?

This is referred to as triple jeopardy. The group with the highest risk of poverty. Here's why

1. In old age people live on fixed incomes with no chance to supplement it.

2. Women, because they live longer also often outlive their income, and, when they were of working age, their incomes were less than their male counterparts (women still make just $.70 to every $1.00 a man earns). This means less available for retirement savings.

3.Minority women have a poor work history in low-paying jobs, interruptions for caregiving and probably no pensions savings or retirement plan.

Based on data from current Population

Reports, "Poverty in the United States: 2002."p60-229, Issued Sept 2003. U.S.

Bureau of the Census

Here is a great link for more info

http://www.aoa.gov/prof/Statistics/profile/2003/2003profile.pdf

There are more black women than black men, and the life expectancy for black males is lower than for white males. Black men live to an average of 62 years and women to as average of 74 years (for further information on the differences see page 353, Health Care and Life Expectancy, in your text).

Blacks are less likely to be married than other ethnic groups, resulting in lower household resources, and are more likely to live with other family members (not a spouse) than are whites.

And, as a result of the Civil Rights Movement, the middle class has grown so much that it now outnumbers the African American poor. This has created a deep class division among African Americans.

The middle class has moved to better neighborhoods, leaving behind the underclass. Elders have been left either in the inner-cities (faced with high crime, the threat of violence and deteriorating neighborhoods) or in rural areas with lack of medical and social services.1/3 (33%) of blacks are locked into a deprivation of chronic welfare, unemployment, high-school dropouts and single parent families.

As a result, older black Americans suffer appalling levels of poverty. Social Security and pensions are based on life's wages. Most worked in labor or domestic jobs with no pensions and low wages.

With no retirement savings, no pensions and minimal Social Security, black elders suffer in lower socioeconomic groups. They have less money to purchase health care, healthy foods and preventative care and thus suffer from poorer health, substandard housing (not adapted for frail elderly, often in deteriorating neighborhoods) yet enter nursing homes at one half the rate of whites.

Sociologists note that these conditions result in lower self-esteem, increased susceptibility to exploitation and many who appear retired are actually "un-retired". These un-retired are aged 55 and over who need jobs but can not find them.

Older Latino's are not a homogeneous group. There is no clear cut definition of who they are. They can be:

| Central and South Americans | |

| Puerto Rican | |

| Cuban | |

| Mexican American or other

Spanish speaking countries |

The Latino population is the fastest growing ethnic population in the United States. It is expected that by 2050, 14% of the over 65 population will be of Latino origin.

There is a high rate of poverty among the Latino elders ( 16.3%). They, too, lacked employment that provided a pension plan during their working lives. Low occupational levels with no pensions means less money in retirement.

Health problems, such as diabetes and obesity, are common in elder Latinos. They do not participate in health prevention because many are suspicious of governmental services and don’t utilize Older Americans Act programs. Many are not in the country legally and fear deportation.

Lack of education, language barriers, high illiteracy rates (second only to Native American elders) cultural values, and lack of money result in isolation and non-utilization of resources.

Many services are modeled after the values of "whites" and are unfriendly to Latinos (e.g. health clinics have small exam rooms which results in no space for family members who traditionally come for support. Latino family values clash with English-speaking work values and often gives the white community the impression of laziness.

Also not a homogeneous group, the majority of Asians in the United States are:

| Chinese | |

| Filipino | |

| Japanese | |

| Korean | |

| Pacific Islanders | |

| Micronesian | |

| Vietnamese | |

| Laotian | |

| Thai | |

| Cambodian | |

| Hmong and others |

Therefore, no single

description of the Asian community’s culture, language, and religion can be

made.

Second generation Asian citizens in

the U.S face difficulty in assimilating into either the American or Asian

culture. Their parents remind them of the tradition of home (country of

origin), yet Asian Americans have been raised in traditional American

institutions (schools, courts, laws and peers). They are likely to be more

educated and more acculturated than their parents.

Elder care among acculturated Asians

may be a burden. While historically in many Asian countries, the eldest son

was assumed to be responsible for his elder parents' care, Western values

have eroded this custom. Few acculturated Asian women want the

responsibility of their husband's parents in their old age.

Generally, Asian elders have enough savings for retirement or they live with family members. However, some have been isolated from their culture and suffer higher rates of poverty and isolation.

Family problems often are kept within the family structure, resulting in under-utilization of services.

Life expectancy among Native Americans is substantially lower than for whites. They are, as a group, a young population. Lack of income leads to poor nutrition and poor healthcare and, thus, a low life expectancy. This means there are fewer elders in the Native American population.

In 1991 nearly 50% were under the age of 25 with elders constituting slightly more than 6% of the total Native American Population (elders are 13% of the white population).

Native Americans suffer from extremely high unemployment rates because few jobs exist on the reservations. If they leave to search for work, they risk losing touch with family, lifestyle and their culture. As a result, many older Native Americans stay on the reservation while the young seek work in the city.

Alcoholism and alcohol-related diseases are disproportionately higher in this population. Generally, they are disposed genetically to have a low alcohol tolerance, but abuse rates are probably related to the stressors of minority status and poverty.

Today, Native Americans still suffer from conflicting federal policies. They are sometimes denied assistance from various governmental agencies under the excuse that the Bureau of Indian Affairs is responsible for providing the denied services .

(Hilliar & Barrows).

Older women typically lead lives much different than older men. They spend their lives caring for children and family and provide 75% of all caregiving in the United States.

Women are more likely to have worked part-time or have gaps in their work histories. When they do work outside the home, historically they have not been as likely to be covered by an employer-sponsored pension.

Women make up three-fourths of all older Americans living in poverty. They are twice as likely as older men to be poor, yet their life expectancy is greater than that of men.

Women suffer from discrimination in the workplace, especially in midlife and older. Women still earn about 70% of what men do. Women traditionally get low pay, inadequate or nonexistence benefits and few opportunities for advancement. Thus, they are far more likely to need public benefits as they age.

Even though there are government programs that can provide cash benefits as well as assistance in paying for food, housing, health care and home energy costs, each year thousands of eligible women do not apply. Application processes and eligibility requirements can be complicated and confusing.

IV. Major Programs That Assist Low-Income Elderly

A. Supplemental Security Income or SSI

This program is administered by the Social Security Office but is not a program of the Social Security Act. Many confusingly mistake SSI as a Social Security Program.

SSI is a needs-based program to meet income needs of older persons with low incomes and those not covered by Social Security.

The following is a direct quote from the Social Security Administrations Web Site. Also refer to your handout, SSI Factsheet.

Supplemental Security Income: (don't confuse this with social security income they are not the same).

The Non medical Rules of EligibilitySSI is a program that pays monthly benefits to people with low incomes and limited assets who are 65 or older, or blind or disabled.

Supplemental Security Income supplements a person's income up to a certain level that can go up every year based on increases in the cost-of-living. The level varies from one state to another, so check with your local Social Security office to find out more about SSI benefit levels in your state.

We don't count all the income you have when we figure out if you qualify for SSI. And if you work, there are special rules we use for counting your wages. Again, check with Social Security to find out if you can get SSI.

In addition to rules about income, people on SSI must have limited assets. Generally, individuals with assets under $2,000, or couples with assets under $3,000, can qualify for SSI. However, when we figure your assets, we don't count such items as your home, your car (unless it's an expensive one) and most of your personal belongings. This is a great web site for information http://www.cbpp.org/7-19-05imm.pdf

Your Social Security office can tell you more about the income and asset limits. For more general information, ask for a copy of the booklet, SSI (Publication No. 05-11000).

B. Public Housing and Rent Subsidies

| Low Income Option. Here are a

few options for low income elders (consult a search engine for more

information on any specific program). |

C. Older Americans' Act programs

Visit the California Department of Aging Web site. Look for the link "About CDA" then jump to "Older Americans' Act" page. Look for the 800 telephone number for referrals to services.

The Older Americans' Act provided the structure for California to pass the Older Californians Act. The act set up the Area Agencies on Aging (33 of them) and the California Department of Aging. The Area Agencies then provide funds for local programs. Look for the Description of Funded Programs at the Area Agency Web site, at their services link. Refer back to lecture one (Online Learning for more on the OAA).

V. Medicare

- Hospital Insurance Trust Fund ( Medicare Part A)

- Supplementary Medical Insurance (or Medicare Part B)

- Medicare Part D- Prescription Drug Coverage

I will cover part A and B, and if you would like to know more about Part D visit this site. http://www.medicare.gov/medicarereform/drugbenefit.asp

Part A- "Hospital" insurance is financed by a portion of your

payroll (FICA) tax that also pays for Social Security.

| |||||

| Part B- "Supplementary Medical

Insurance" is partly financed by monthly premiums paid by people who

choose to enroll (in 2008 the premium is $96.40-$110.50 depending on

ones income). | |||||

| Each part of Medicare covers a

different kind of medical costs. | |||||

| Some people think that Medicaid

( in California it is called Medi-Cal) and Medicare are two different

names for the same program. Actually they are two different programs. | |||||

| Medicaid or Medi-Cal is a State-run program (funded partly with Federal funds) is designed primarily to help those with low income and little or no resources. One must meet poverty guidelines to qualify, and it is therefore, a needs based-program. Medicare, on the other hand, is part of Social Security and, therefore, an entitlement program. | |||||

| If you are interested this site gives more details about the costs, deductibles and programs. https://questions.medicare.gov/app/answers/detail/a_id/2260/~/medicare-premiums-and-coinsurance-rates-for-2010 |

One is automatically enrolled in part "A" if at age 65-67 you are also eligible for Social Security .

However, one must pay a monthly premium for Part B coverage. There is also the option of turning it down (unless you also enroll in a Health Maintenance Organization (HMO) discussed later).

One can also be eligible if he/she receives Social Security disability, and, under certain conditions, your spouse, divorced spouse, or widow may be eligible when they turn 65-67 (based on their spouse’s work record).

If someone is not eligible under these rules he/she may be able to get Medicare by paying a monthly premium.

Under this rule, you can enroll in part "A" even if you did not earn work credits. You must be a legal citizen of the U.S. for a least five years before applying.

For each benefit period you pay:

|

A total of $1,100 for a hospital stay of 1-60 days.

| |

|

$275 per day for days 61-90 of a hospital stay.

| |

|

$550 per day for days 91-150 of a hospital stay (Lifetime Reserve Days).

| |

|

All costs for each day beyond 150 days.

|

Skilled Nursing Facility Coinsurance

|

$137.50 per day for days 21 through 100 each benefit period.

https://questions.medicare.gov/app/answers/detail/a_id/2260/~/medicare-premiums-and-coinsurance-rates-for-2010

|

Part B is purchased much like private insurance. If you want Part B, you must enroll in Part A.

Low income Medicare Beneficiaries can receive help with monthly premiums through a means-test program called Qualified Medicare Beneficiary (QMB).

The QMB program is run by the Health Care Financing Administration and by the State Health and Human Services Depart.

Medical (Part B) insurance helps pay for doctor’s services, and many medical service and supplies that are not covered by Part A. (e.g. X -rays, ambulance services, outpatient hospital care).

Part B generally pays 80% of approved charges.

Many elderly are under the assumption that Medicare will take care of all their medical needs when they age. Besides the lack of coverage for long-term care, Medicare does not cover:

| prescription drugs (some coverage under part D) | |

| services outside the U.S. | |

| routine physical exams | |

| eye exams | |

| hearing aids | |

| dental or foot care | |

| chiropractic | |

| immunizations (pneumonia shots are covered) | |

| custodial care |

Medicare beneficiaries may now choose how they’ll receive hospital, doctor and other health care services covered by Medicare. The choice may affect the amount of money paid for services.

Most people use the traditional "fee-for–service" system—visiting the hospital or doctor of their choice and paying a fee each time. But more and more are turning to Health Maintenance organizations or HMO’s.

HMO’s that have contracts with Medicare are a network of doctors, hospitals and other health care providers that agree to give care in return for a set monthly payment form Medicare.

Beneficiaries in managed care plans may be restricted as to which doctors and hospitals they can use.

| Managed care plans

that participate in Medicare cover all the services covered

by the original Medicare plan. | |

| Some cover

additional services such as prescription drugs. | |

| Some charge a premium for additional covered services. |

If you enroll in an HMO, you must also agree to enroll in Part B and continue to pay your monthly premiums.

For many, a managed care plan can reduce your out-of –pocket expenses for deductibles and co-payments and can reduce billing and paper work.

If you are enrolled in a managed

plan, you do not need Medi-gap insurance (explained below):

| Because of complaints of

long authorization times, service limitations by administration of HMO’s, many customers choose to remain in a fee-for- service system. You may later dis-enroll from the HMO plan if you become dissatisfied with their services. |

G. Medigap Insurance

Traditional "fee-for-service" Medicare coverage (Part A and Part B) provides basic health care coverage. As you have seen, it does not pay all medical expenses, and it does not pay for most long-term care.

Many people choose an insurance policy to fill in the gaps . This is often called Medi-gap.

It is difficult to summarize Medi-gap insurance. The Health Care Financing Admin. publishes a booklet with information on supplementing Medicare coverage. It’s called Guide To Health Insurance For People With Medicare (publication #HCFA02110) and is available from any Social Security office or by writing to:

Medicare Publications, Health Care Financing Admin

7500 Security Blvd.

Baltimore, Maryland 21244-1850

VI. Estate Planning ( for California Residents)

- Estate planning is a lifelong process in which you evaluate your situation and plan for the future. It includes:

| Planning for retirement | |

| The possibility of disability | |

| Planning for death

and distribution of your assets |

The process can be a positive experience since it involves reviewing your situation and planning for your future, but, for others, it is unpleasant to think about the possibility of disability or death.

But estate planning can reduce potential distress for a family later when the stress of the death of a family member can evoke a wide range of emotions.

For many, a combination of financial consultants, accountants, lawyers, doctors and insurance agents are part of the planning process. Issues to consider include:

| how to distribute your assets | |

| care of minor

children (if you are a grandparent raising a grandchild or a young adult with minor children) | |

| avoiding probate court | |

| setting up

living trusts or other legally binding situations to minimize or reduce estate taxes |

Elder Care Attorneys specialize in estate planning and can explain these options or log onto www.ca-probate.com/chap_idx.htm for help

If an elder needs an attorney for estate planning and can’t afford one, the Alameda County Bar Association, Community Services, has produced a 34-page "Legal Services Directory" identifying many free and low-cost legal programs in the county. They can be reached at 510- 893-1031.

There are also many good books at the library on estate planning. One that is often recommended is Harvey Platt’s Making a Will and Creating Estate Plans, (Longmeadow Press, 1991,$4.95).