More about The Boomers

And Still More About the Baby Boomers

So much has been written about how the Baby Boomers will age; that historically large population born between 1946 and 1964. While information regarding their levels of savings for retirement, or lack of, and the shrinking numbers of employer-sponsored retirement plans has been the focus of many writings and lectures in this class.

Much of what is written regarding the Boomer’s retirement comes not from current facts but instead from asking the Boomers themselves about their projected preferences. Scholars, as well as lay people, study these responses and extrapolate what this generation might be like in their old age, assuming their responses don’t change between now and then.

Based on these predictions we also try to predict what society might do to respond to their projected needs. For example, Pew Research Center recently posted research looking at intergenerational relationships within families of Boomers. If you are interested you can download this report at http://pewsocialtrends.org/pubs/306/baby-boomers-from. So while we can actually count savings and retirement plans actual details regarding the Boomers reaction to old age are mostly speculation.

As the Boomers moved through their childhood they were the beneficiaries of many more social comforts and conveniences than any previous generation because of the post war, pent-up, economic boom.

Men, who had been absent from family life while fighting World War II returned with the desire and funds to begin their families, purchase homes, and furnish their homes with luxuries never seen by their parent’s generation.

They were the first to purchase televisions, automatic washing machines, and new suburban homes in such large numbers.

Credit and credit cards made purchasing easier and more wide-spread than ever before.

The Boomers are the first generation to grow up with these modern comforts.

They also demand more of society as they grew. More doctors, especially pediatricians, were needed to care for their childhood medical care, more schools and colleges to educate them, more manufactured clothes and toys, and thus more jobs were created. Predictions remain high that they will continue to demand more of society as they move into their retirement years. Services such as retirement planning, travel and leisure services, assisted living facilities, long term care, and end-of-life care are predicted to increase in demand as the Boomers move through their old age.

How the Boomers will move through these chapters in their lives can only be speculated. Many writings have addressed questions such as:

“Have they saved enough money to last into the new advancing life expectancy”?

“How will their retirement affect the economy, the stock market, and the imaged or real fear of a questionably solvent Social Security system”?

“Will they break an already overloaded entitlement system?”

Other important questions focus on social concerns.

“Will they continue to work past the normal retirement age of 65 years and thus continue to contribute to Social Security trust fund thus averting the predicted collapse of the program?

Will they want to retire?

Will we need large public programs to support them in their old age?

Show Me The Money

The Boomer generation will need more savings to retire than previous generations because of advances in life expectancy. Their parent’s were expected to live an average of just 65 years. Today that number is closer to 80 years. http://www.washingtonpost.com/wp-dyn/content/article/2009/05/06/AR2009050603322.html

Some answer these social and financial questions with an economic dooms-day picture. Their reasoning goes something like this.

| Social Security has always been a pay-as-you go system (at least until 1976 but more about that later). This means that the payroll tax of the current working-age population goes to support the retirement benefits for current retirees. Currently, it takes about five workers to pay the benefits for one retiree. |

This argument continues that when the Boomers start to retire, because of fewer births in the generation following them, the number of people in the work force will be reduced . This means that the worker to beneficiary ratio will drop. There will not be enough workers to pay the taxes needed for the growing number of retirees and their monthly benefits. Young workers have been told that Social Security is going broke because of this scenario and nothing will be left for them when they retire. This reasoning also predicts that because of the size of the Boomer generation they are also going to break other entitlement programs such as MediCare.

Doomsday predictions feed off of the assumption of a slower economic productivity, slower growth, and a resulting sluggish debt-ridden economy (caused by fewer workers to pay taxes and the retirement of the Boomers).

These assumptions might be challenged for a few documented reasons.

First, it is not the size of the Boomers that is taxing the entitlement system, specifically Social Security, but instead the amount of government spending. The Boomer’s have pre-funded, saved for their retirement benefits by paying higher social security taxes on their income during their working years. This pre-funded money was barrowed by the US Government to help pay for the federal overspending.

Second, the demographic doomsday does not take into account a large population surge that occurred just 10 years after the lower birth rates which are commonly referred to as the Birth Dearth. ___________________________

|

Remember this Discussion? After 1976 there was again another birth explosion-- larger than the boomers. Demographers call it the Echo Affect. With an echo there is a lag period between the initial event and the witnessing of the echo and so it was with the birth of this generation. After the Boomers had aged some they started having children. In fact, Boomers in their 30’s and 40’s (and towards the end of the cycle 50’s) were becoming first-time parents. Between 1977-1990- over 80 million babies were born. We call them the Net Generation – and they cut their eye teen on the technology their siblings modeled for them. It seemed natural |

Boom,

Bust Echo

|

|

Period |

Years lasted |

Number of Births |

|

Boom |

1946-1964 |

19 years |

77.2 million |

|

Bust |

1965-1976 |

12 years |

44.9 million |

|

Echo Affect |

1977-1997 |

21 years |

81.1 million |

The reason the Echo affect lasted so long was because the

Boomers whose biological clocks were ticking were making up for lost time.

Government

Spending and Pre-Funding:

As noted above before the boomers started "pre-funding" their retirement, Social Security

had historically been funded on a pay-as- you-go basis. In this system taxes and

benefits are adjusted so that there is no reserve funds accumulated. As

explained earlier under the pay-as-you-go system the elderly are not supported

by their own tax payments, but instead by the current taxes paid by younger

workers. This is essentially how Social Security was structured from the

1950-1970’s with each generation supporting the benefits of the previous

generation.

When the large numbers of Baby Boomers become eligible for Social Security retirement benefits the worker-to-beneficiary ration will to drop. There will be just two workers for every senior citizen collecting benefits, (compare this to 15 to 1 ratio when the program first began). The Social Security Administration recognize this problem and took some corrective measures to avert disaster and compensate for this boom.

First, in 1983 the maximum annual salary subject to Social Security tax was increased. This resulted in more funds being collected than the program needed at that time. You can check these rates here http://www.rrb.gov/pdf/act/taxrate.pdf

This increase in the Baby Boomer’s payroll taxes thus created a Social Security savings account changing Social Security from a pay-as-you-go system to a pre-funded system allowing the fund, for the first time, to have a surplus of money. Since then, trust fund reserves have gone from nearly zero to $2.4 trillion. The surplus is kept in a reserve (more about the reserve later) to fund the program when the workforce to beneficiary ratio decreases and this huge generation starts to retire.

This method of funding the Social Security system shifted the retirement burden from future younger workers to the Baby Boomers themselves. Thus, the Baby Boomers not only funded the retirement benefits of the generation before them, but have also funded their own retirement benefits. They have put in reserve monies needed to pay their Social Security benefits.

Other steps were taken to keep the fund solvent. The administration increased the age of retirement from age 65 to age 67, reduce benefits for early retirement ( age 62) , and created a penalty for excessive earnings once retired (this has since been amended).

So What’s the Problem?

Originally, it was believed that pre-funding the system would keep Social Security solvent for the next 75 years but the predictions did not take into account future government spending and the need for money to fund that spending.

Under the current system, all surplus Social Security revenue is invested in U.S. Treasury bonds. The trust fund reserve invested in U.S. bonds. By the endo fo 2022 the reserves are estimated to be $3.7 trillion .http://www.cbpp.org/cms/index.cfm?fa=view&id=2819

U.S. Treasury bonds have generate almost $90 billion in interest for the fund at an average rate of 6% . These bonds are backed by the full faith and credit of the United States. This means that the nation is fully obligated to honor them when they are redeemed which is supposed to be when the Boomers start to retire and the worker-to-beneficiary ratio drops.

Because of large budget deficits the federal government began the practice of using Social Security's savings to meet huge budget deficits.

The Reagan Years 1981-1989

It started mostly with defense spending of the Reagan years. For those who

remember, Reagan was spending large amounts of tax dollars on his "Star Wars"

program. In order to gain support for the program he needed to assure the public

(and Congress) that the money he was spending was not excessively outside of

federal income.

With Social Security's savings (pre-funding monies) the taxes being collected for federal spending suddenly looked much larger than they were. This made it easier for Regan to continue to nearly triple the national debt.

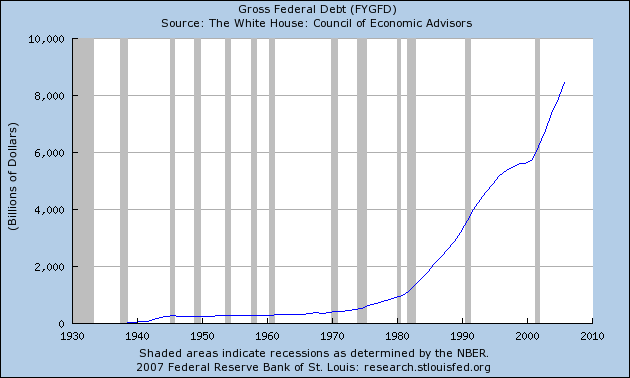

Here is a chart showing the increase in federal spending. You can see that around 1980's the debt escalated

Y

Y

http://www.huffingtonpost.com/hale-stewart/ronald-reagan-fiscal-disa_b_82370.html

“It has been said that this practice is analogous to taking money from someone's piggy bank to run your monthly expenses and declaring that your income had suddenly increased.” http://www.aarpmagazine.org/money/Articles/myths_and_truths_about_social_security.html

Currently the government continues to borrowing more than $150 billion a year from the Social Security trust fund, which Congress is using for various purposes at home and abroad. After more than 30 years of borrowing from Social Security, in 2028 the U.S. Treasury had to start redeeming the U. S. Treasure Bonds. This is a significant date for Social Security “not because the program was in financial trouble at that point, but because the rest of the U.S. budget may be in trouble due to unsustainable spending”. How will the U.S. Government cut spending to pay back these bonds?

It is true that the Social Security actuaries’ project that the trust fund will be depleted 2042. However, even after that date, Social Security will not be "bankrupt." According to the AARP web site “ annual collections from payroll taxes would be sufficient to pay over 70 % of promised benefits.” http://www.aarp.org/aarp/presscenter/testimony/articles/rother_ss_testimony.html

|

Did you know? Here is are great visuals of who owns our treasury bonds and thus the National debt http://www.marketoracle.co.uk/Article1571.html |

Demographics We Don’t Hear Much About

The outlook for Social Security

depends on the growth of the economy. If we have more workers more taxes are

paid into the fund which can then be used to support retirees (back to the

pay-as-you-go system).

If you look at the demographics presented above it is interesting to see that after the 10 years of a birth dearth in 1976 the birth explosion. In fact it was larger than the Baby Boomers.

According to Merriam-Webster on line (http://www3.merriam-webster.com/opendictionary/newword_search.php) a generation is defined as the time that it takes for a species to complete one full cycle, from adult to offspring and according to Dictonary.com in term of years, roughly 30 among human beings is accepted as the average period between the birth of parents and the birth of their offspring. This is important data if you subscribe to danger of not enough workers in the generation after the Boomers to support their retirement benefits for a few reasons.

|

Did You Know? Their cohort effects were different from their younger counterparts who really were too young to have experienced these events. Yet because the birth wave continued to spike until 1964 they have been included in this generation. |

Those born between 1955 and 1964 are considered “Late Boomers”. A nearly ten year period separates their births. As you can see from the graphs above the drop in births after the Boomers also lasted nearly 10 years before another birth spike, of nearly 80 million net-generations children, were born.

If a generation is indeed one complete life cycle or 30 years it is note worthy that just 30 years passed between the beginning of the Baby Boom generation and the Beginning of the Echo Effect generation. These leading edge net-genners, today aged 32, are currently entering the work force, already paying payroll taxes and adding to the economy--one condition being cited as needed to avert the dooms-day disaster scenario.

Conclusion:

The predictions that the Baby Boomers will bust the economic system of the United States may need to be revisited. First, the Boomers themselves have not only supported their parent’s retirements but have already paid for their own retirement by pre funding Social Security.

Monies the Boomers put aside to pre fund their retirement benefits are owed to the Trust Fund and the U.S. Government is obligated to repay those funds. Some ask how this bill will be re paid since as a Nation we are spending way beyond our income means and monies to pay this debt is not apparent.

Second, it would appear that there will never be a time when the Baby Bust cohorts will be solely responsible for supporting Social Security. The Echo Effect generation nearly 80 million strong are already entering the work force, paying taxes and thus contributing to Social Security.

Sources:

(David Ignatius). http://www.washingtonpost.com/wp-dyn/content/article/2009/05/06/AR2009050603322.html

http://www.pbs.org/newshour/bb/medicare/july-dec97/medicare_7-15.html

On line news hour June 1997.

http://www.cbpp.org/cms/index.cfm?fa=view&id=2819

http://www.aarpmagazine.org/money/Articles/myths_and_truths_about_social_security.html

http://www.huffingtonpost.com/hale-stewart/ronald-reagan-fiscal-disa_b_82370.html

http://www.cbpp.org/cms/index.cfm?fa=view&id=2819

http://www.marketoracle.co.uk/Article1571.html

http://www.aarp.org/aarp/presscenter/testimony/articles/rother_ss_testimony.html Social Security Do we Have to Act Now?

http://www.aarpmagazine.org/money/Articles/myths_and_truths_about_social_security.html

http://www.treas.gov/tic/mfh.txt

Tapscott, Don Growing up Digital, the rise of the Net Generation: McGraw Hill. New York. New York.