Short-Range Actuarial Estimates

For the short range (2004-2013), the Trustees (http://www.ssa.gov/OACT/TR/TR04/II_project.html#wp77635) measure trust fund adequacy by comparing assets at the beginning of each year to projected program cost for that year under the intermediate set of assumptions. Having a trust fund ratio of 100 percent or more--that is, assets at the beginning of each year at least equal to projected outgo during the year--is considered a good indication of a trust fund's ability to cover most short-term contingencies. Both the OASI and the DI trust fund ratios under the intermediate assumptions exceed 100 percent throughout the short-range period and therefore satisfy the Trustees' short-term test for financial adequacy. Figure II.D1 below shows the trust fund ratios for the combined OASI and DI Trust Funds for the next 10 years.

Long-Range Actuarial Estimates

The financial status of the trust funds over the next 75 years is measured in terms of cost and income as a percentage of taxable payroll, trust fund ratios, the actuarial balance (also as a percentage of taxable payroll), and the open group unfunded obligation (expressed in present-value dollars). Considering Social Security's cost as a percentage of the total U.S. economic output (gross domestic product or GDP) provides an additional perspective.

The year-by-year relationship between income and cost rates shown in figure II.D2 illustrates the expected pattern of cash flow for the OASDI program over the full 75-year period. Under the intermediate assumptions, the OASDI cost rate is projected to decline slightly between 2004 and 2007 and then increase up to the current level within the next 3 years. It then begins to increase rapidly and first exceeds the income rate in 2018, producing cash-flow deficits thereafter. Despite these cash-flow deficits, beginning in 2018, redemption of trust fund assets will allow continuation of full benefit payments on a timely basis until 2042, when the trust funds will become exhausted. This redemption process will require a flow of cash from the General Fund of the Treasury. Pressures on the Federal Budget will thus emerge well before 2042. Even if a trust fund's assets are exhausted, however, tax income will continue to flow into the fund. Present tax rates would be sufficient to pay 73 percent of scheduled benefits after trust fund exhaustion in 2042 and 68 percent of scheduled benefits in 2078.

|

|

Social Security's cost rate generally will continue rising rapidly through about 2030 as the baby-boom generation reaches retirement age. Thereafter, the cost rate is estimated to rise at a slower rate for about 15 years as the baby boom ages and begins to decrease in size. Continued reductions in death rates and relatively low birth rates will cause a significant upward shift in the average age of the population and will push the cost rate above 19 percent of taxable payroll by 2078 under the intermediate assumptions. In a pay-as-you-go system such as OASDI, this 19-percent cost rate means the combination of the payroll tax (scheduled to total 12.4 percent) and proceeds from income taxes on benefits (expected to be 1.0 percent of taxable payroll in 2078) would have to equal more than 19 percent of taxable payroll to pay all currently scheduled benefits. After 2078, the upward shift in the average age of the population is likely to continue and to increase the gap between OASDI costs and income.

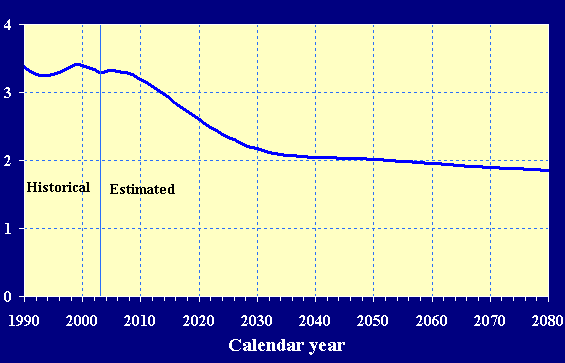

The primary reason that the OASDI cost rate will increase rapidly between 2010 and 2030 is that, as the large baby-boom generation born in the years 1946 through 1964 retires, the number of beneficiaries will increase much more rapidly than the number of workers. The estimated number of workers per beneficiary is shown in figure II.D3.

In 2003, there were about 3.3 workers for every OASDI

beneficiary. The baby-boom generation will have largely retired by 2030, and the

projected ratio of workers to beneficiaries will be only 2.2 at that time.

Thereafter, the number of workers per beneficiary will slowly decline, and the

OASDI cost rate will continue to increase.

|

Source:

2004 OASDI Trustees Report http://www.ssa.gov/OACT/TR/TR04/II_project.html#wp77635, accessed 2005

|